An exclusive strategic advisor on corporate finance matters

Originally dedicated exclusively to large companies, a « House Bank » is the go-to advisor for all strategic corporate finance matters. Managers and shareholders have an intimate relationship with their advisor, based on exclusivity and trust. The “House Bank” is commonly represented or invited to the Board of Directors.

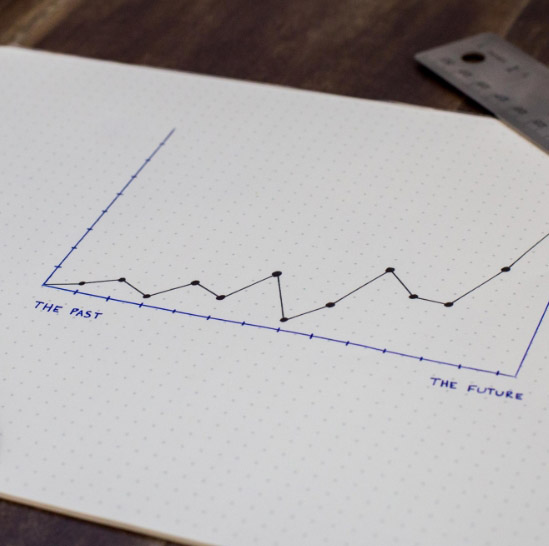

Over the last two decades, M&A advisory has grown amongst small and medium-sized enterprises, mostly taking the form of a transactional offer with a sector-specific approach, and often consisting in the implementation of standardised M&A processes.

Founded in 2013, D&A is positioned as a “House Bank” dedicated to the mid-market, providing strategic corporate finance advisory and leading deal execution.

Our team pools experiences in Private Equity, M&A, executive management and audit, enabling an outside-the-box approach to corporate finance and governance.

Our loyalty and implication mean we are the privileged advisor to companies and entrepreneurs.

We do not hold back on challenging our clients if it means preserving their interests. We act as a « sounding board » and do not limit ourselves to telling our clients what they want to hear.

The intimacy we nurture with our clients allows us to gain a deep understanding of their needs and to elaborate tailored solutions.